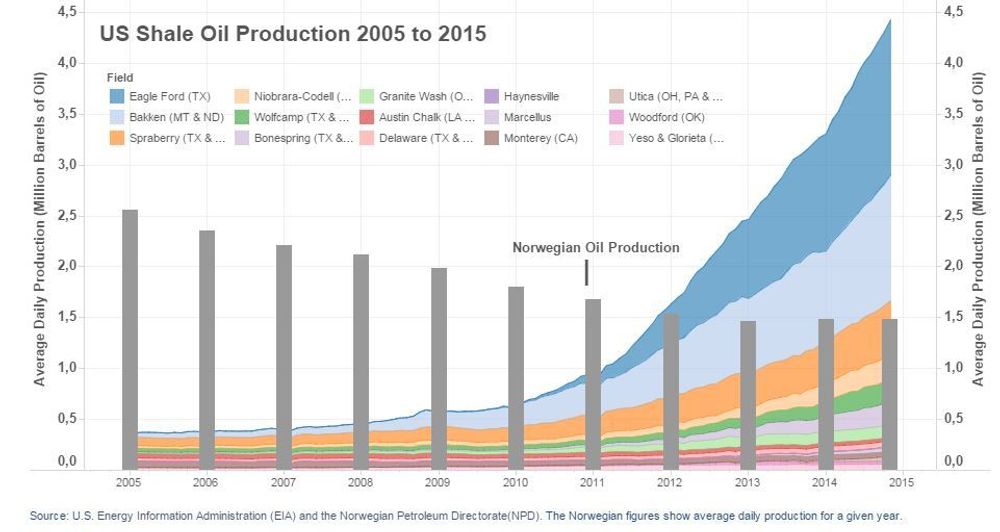

Recently TU Jobs wrote that the giant shale oil area, Eagle Fjord in Texas is one of the most important reasons for falling oil prices since summer.

Eagle Ford is one of 15 shale oil fields that have taken the world by surprise with a highly aggressive production growth since 2011.

The growth lead to overcapacity in the market and the following price fall.

Oil analyst Torbjørn Kjus has previously said to Teknisk Ukeblad that the US shale revolution is the biggest surprise in the history of oil.

Produces three times more than Norway

Kjus is probably right: the USA is now producing three times as much shale oil a day as the entire Norwegian oil production.

In October, Norway produced 1.5 million barrels of oil a day, while the shale oil production was just below 4.5 million barrels.

Oil only

This is what numbers from the Energy Information Administration (EIA) show. The agency is part of the United States Department of Energy, and offers official reports on production of oil, gas and coal, but also renewable energy, electricity and nuclear power.

The EIA have provided us with the production numbers of all the growing shale oil fields in the US, that we made an overview of.

In the overview we focused on oil, and not gas. We compared this to the average daily production of oil in Norway since 2005.

We want to emphasize that this illustration only shows the production of shale oil, not the rest of the oil production in the US, precisely to illustrate the size of revolution that shale oil actually represents.

Production will grow

But it doesn’t end there. The US production shows no sign of slowing down, something several analysis and energy companies eagerly highlight.

This is bad news for Norway, where the oil companies and service industry are downsizing across all corners.

For example, the analyst agency Citigroup expects that US oil production will increase with one million barrels a day in 2015, from the nine million barrels of today.

One of the most important reasons for this is that the break-even price of shale oil projects, the oil prices the companies need to go in plus, are steadily falling.

Giant field

In Eagle Ford, the average breakeven price is 50 dollars.

The analysis agency Wood Mackenzie thinks that Eagle Ford alone will produce 2.8 million barrels of oil equivalents every day of 2015. To compare: In 2008, there was almost no production of neither oil or gas from the field.

New technology drives the price down

The reason for the great increase is that a few years ago there was a lack of belief that shale oil production would be profitable because of expensive and ineffective production methods.

But with several leaps of technology the last years, the oil companies have now reduced costs drastically.

For example, the analysis agency Oppenheimer points out that several companies can drill a well in two weeks instead of three months, something that means spending a fraction of what was previously spent on rig hire.

Furthermore, more wells can be drilled with the same rig, something that was unusual five-six years ago.

This results in oil companies investing massive amounts in shale oil projects.

The analysis agency Wood Mackenzie estimates that the company will spend the dizzying 993.25 billion Norwegian kroner on the following fields in 2015:

- Eagle Ford: 30.8 billion dollars (220 billion kroner)

- Bakken: 16.7 billion dollars (119 billion kroner)

- Wolfcamp/Cline: 16.3 billion dollars (116 billion kroner)

- Marcellus: 11.7 billion dollars (83 billion kroner)

- Scoop Woodford: 6.1 billion dollars (43 billion kroner)

- Niobrara: 6.1 billion dollars (43 billion kroner)

- Utica: 5.4 billion dollars (38.6 billion kroner)

- Bone Spring: 5.3 billion dollars (37.9 billion kroner)

- Haynesville: 2.2 billion dollars (15.75 billion kroner)

- Other land based projects: 38.7 billion dollars (277 billion kroner).